AMD Still in the Game, Q3 Financial Reports Show Steady Progress

At the closing of today’s trading, Advanced Micro Devices, Inc. (AMD) released its earnings report for the third quarter of 2022. The business generated $5.6 billion in revenue, representing robust 29% annual growth at a time when the industry is experiencing an inflationary slump.

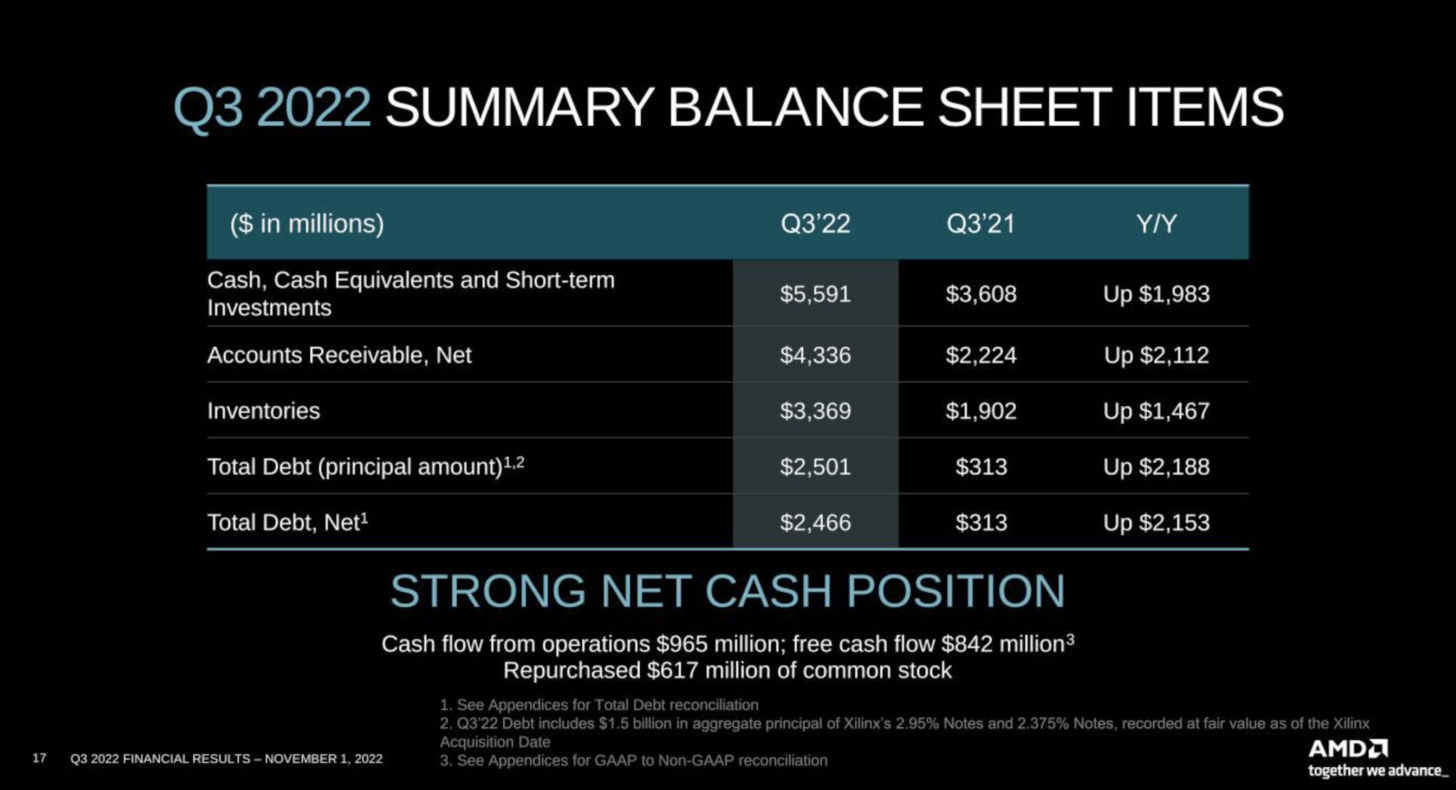

The results were in line with AMD’s preliminary projections provided at the beginning of October. More importantly, AMD’s non-GAAP earnings and cash flows all showed healthy growth, showing that the company is on the strong ground even though the GAAP results showed an operational loss following its acquisition of Xilinx. The operating and free cash flows of the company are the main findings from AMD’s most recent quarterly earnings.

However, a quick glance at its revenue statement reveals that the projections made at the beginning of October were accurate. In addition to a 40% yearly decline in its client sector, which reports income from sales of personal computers and notebook products, it had predicted that AMD would generate $5.6 billion in revenue and $1.5 billion in operating expenditures in the coming year. The company reported a net operating loss of $64 million for the quarter, according to today’s results, which also verified that AMD’s costs related to its acquisition of Xilinx were included.

In terms of net income, AMD reported $1.1 billion in non-GAAP income and $66 million in GAAP income, representing a 23% gain and a staggering 93% yearly reduction, respectively. The GAAP statistic represents the real profits per share that are available to consumers at the conclusion of a quarter, but the non-GAAP number is used to assess performance. AMD reported GAAP EPS of 4 cents and non-GAAP EPS of 67 cents, respectively.

During the quarter, AMD generated $842 million in free cash flow and $965 million in cash flow from operations. These increased by 15% and 10% annually from the comparable quarters’ $849 million and $764 million levels from the previous year, respectively. The operating cash flow is the amount that the company really produces from operations after inflation and other non-cash expenditures have been taken into account.

Despite slowing from its exceptional growth due to customers struggling with high inflation, AMD’s rise in both metrics demonstrates that the company improved its operational performance in the third quarter. Looking ahead, AMD projects sales of $5.5 billion for the current quarter and $23.5 billion for the whole 2022 fiscal year. The company’s sales for the fourth quarter of 2021 was $4.8 billion, and its total revenue for the year was $16 billion, representing a startling yearly rise of 68%.

Despite AMD’s shares suffering losses on the market this year, the projections demonstrate that the company’s growth narrative is still very much intact.