Samsung Memory Chip Business is Expected to Make a Comeback This Year, Profit Recovery Forecasted in H2 2024

DRAM production is expected to reach pre-2023 levels in the second half of this year.

Samsung’s memory semiconductor business is reportedly expected to recover this year. Analysts have predicted that by the end of this year, Samsung’s DRAM manufacturing will look to recuperate the returns that they had been deprived of for the past year.

Samsung Memory Business’ Worst Year Since 2009

For context, 2023 wasn’t the best year for Samsung’s DRAM business. The chipmaker’s largest profit-generating segment, semiconductors, was under pressure for most of the year—losses of over 4.58 trillion, 4.36 trillion, and 3 trillion won were recorded in the first three quarters of the year, respectively. The fourth quarter was the least damaging, with ~ only 14% losses recorded. These were the worst numbers that the company had seen since 2009.

While Samsung saw a mind-boggling 95% decline in profitability in 2023, the statistics above and the decreasing loss pattern tend to provide a solid basis for understanding the general trend—recovery is slow but imminent.

Samsung is the largest memory chipmaker in the world, but in a volatile industry, the company needs to keep investing. Looking at the past 15 months, this has come off as draining money into a pithole. Still, according to research firm Omdia, Samsung may end up finally recovering to similar levels to last year in the second half of 2024.

Memory Semiconductor’s Recovery Trend; Might Recoup Profits in H2 2024

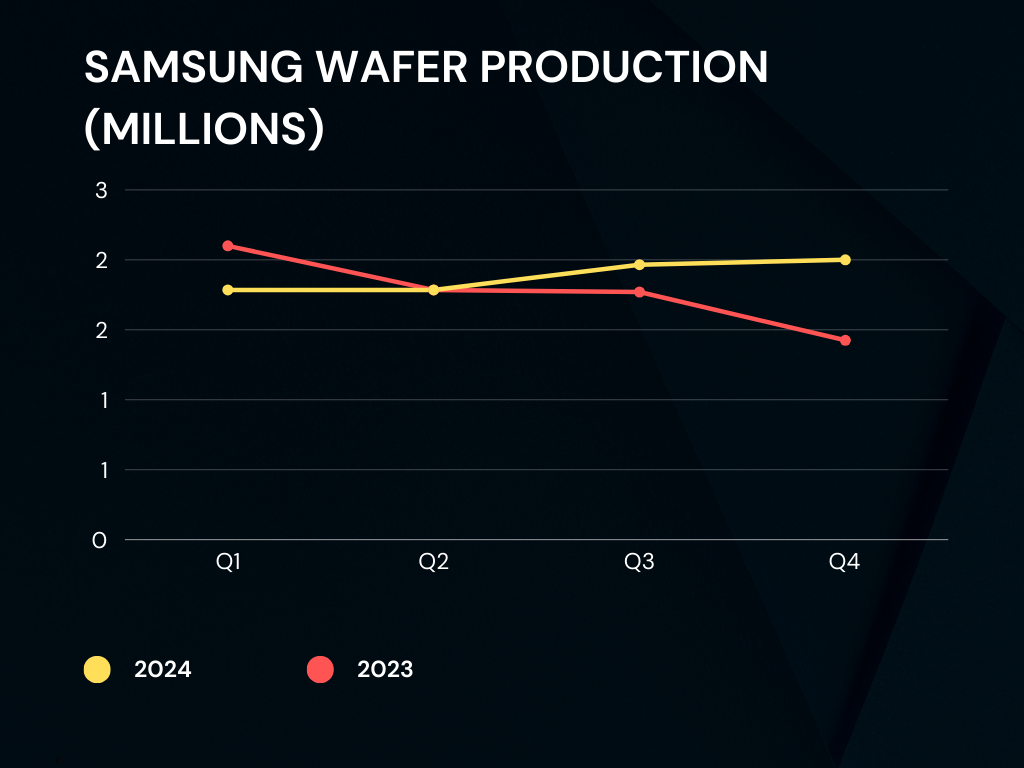

Samsung’s wafer production numbers for the first half of 2024 accumulated to about 1.575 million units, 75% of the 2.1 million units it produced in the same quarter last year. However, this 25% gap is expected to close to about 0% as the predicted forecast numbers are 1.785 million units, the same as those of Q2 2023.

This upward trend will likely not stop here, as production will ramp up to 1.965 million units in Q3 2024, this time overtaking the production numbers of the third quarter of last year, which were 1.77 million units, marking an 11% improvement. For the last three months of 2024, the quarterly projection is expected to cross the 2 million barrier, this time marking a 41% rise from that of Q4 2023, which came at about 1.425 million units.

HBM & AI Chips Will Be the Main Profit Drivers

Samsung will now be looking to recover lost profits. It will do this by selectively focusing on its memory business. For example, it will pour more resources into its HBM chips, which will, in turn, improve profit margins. This is why a report from SeDaily points out that production will increase, but only along specific lines.

The Hwaseong 15, Pyeongtaek facility, which produces HBM products, is seeing increased production numbers, but others, like the Hwaseong 13 line, which makes image sensors, are still looking at numbers worse than that of the same period last year.

This is all we know for now, but rest assured that we will keep you updated as new information becomes available.